Launching and running a business is an exciting venture, but...

Read MoreWhen you’re starting a new business, it can be tough to know whether or not your operation is ready to get a business credit card. There are a lot of factors involved, and most of them aren’t things you can see from the outside. But there are some signs that are pretty clear indicators that you’re on the right track.

Here are five signs that you should get yourself a business credit card:

You want a business loan down the road.

If you plan to seek financing for your business in the future, accepting credit cards can prove beneficial in building a strong credit history, which lenders often look at when determining whether or not they’ll grant a loan.

Credit cards can help you build credit and show lenders you’re financially responsible — two important factors when it comes to getting approved for a loan. But they also offer low-interest rates and other perks like rewards points and discounts, which can help boost profits if used correctly.

You need cash flow. If you’re paying for everything with cash, having an extra line of credit could be helpful. If something happens where you need cash quickly — like an unexpected repair or an emergency purchase — opening up a credit card can be easier than cashing out your savings account to cover unexpected expenses because it allows you to pay back the debt over time with interest charges attached.

You Travel a lot

If you travel often and your company can afford the expense, then it may be worth getting a business credit card. Business cards often come with travel rewards programs and other perks that can help offset the cost of travel. You can use these cards at restaurants or hotels, which will help stretch your euros further than cash or debit cards would allow.

Check our community deals and see which deals you can enjoy with the everest card.

You Buy a lot of suppliers or inventory

If you find yourself buying a lot of inventory, it might be time to expand with a credit card.

For example, if you’re buying a lot of different supplies from different vendors or suppliers, but don’t have enough capital to buy it all at once, putting that big initial bill on your credit card will allow you to spread out the cost over time and save you money in interest payments.

You have employees who make purchases for the company

If you have employees who make purchases on their own behalf or on behalf of the company, then having them use an employee card can provide some transparency into their spending habits while also keeping track of all expenses in one place.

You can use a credit card to pay for travel expenses and other things related to running your business properly.

You do want to maximize your spending

Credit card payments are more secure than cash and checks, which means less risk for you as a merchant. And because credit cards allow customers to make purchases on their terms — with no need for immediate payment — they can help increase sales. With lower transaction fees, faster payment processing and better fraud protection, accepting credit cards is often less expensive than other forms of payment, too.

Ultimately, we don’t think that there’s an official point at which your business will absolutely need a credit card. But when you’re ready to put in the work to get one, it can be a huge boon to your bottom line on every level. And if you’re not exactly sure whether now is the right time, don’t worry.

All business owners have different situations, and what works for you might be different from what works for someone else. That’s why it’s so important to take a considered approach to such financial decisions—for your sake and for the sake of your business.

To find out if everest card is right for your business, visit everestcard.com or send an email to support@everestcard.com.

You migh also like

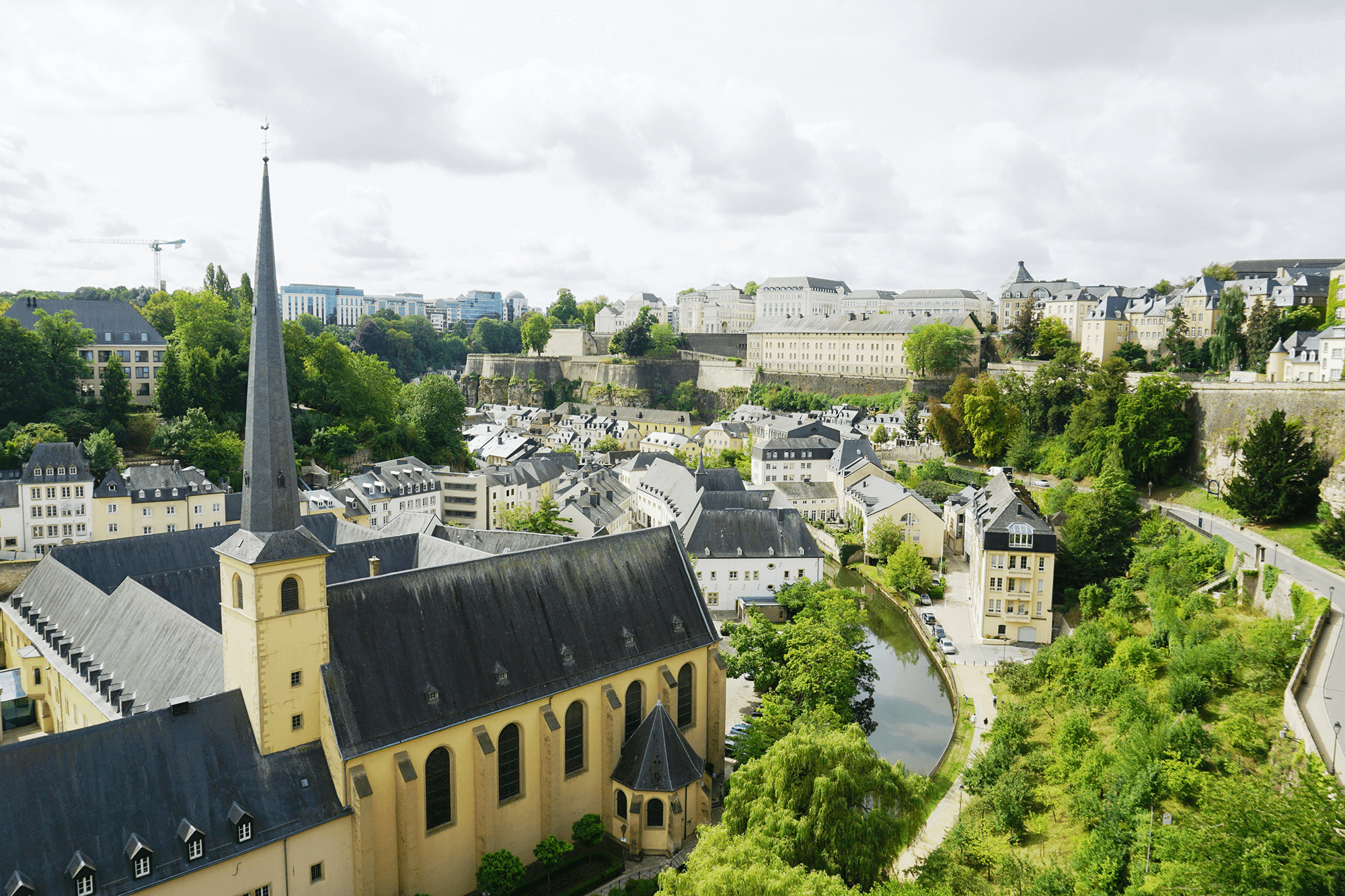

The top Financial Services for SMEs in Luxembourg

For small and medium-sized enterprises (SMEs) in Luxembourg, accessing the...

Read More