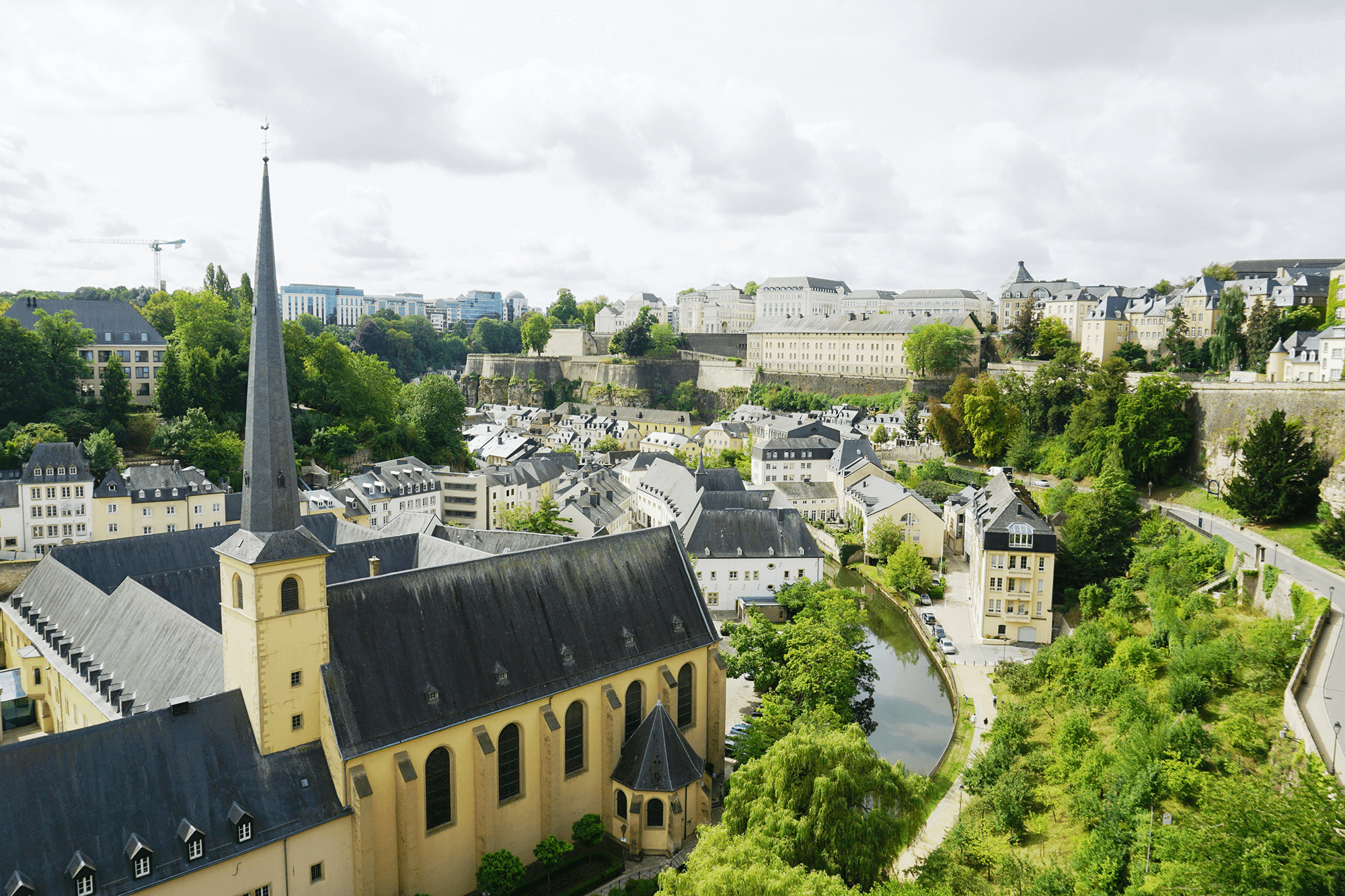

For small and medium-sized enterprises (SMEs) in Luxembourg, accessing the...

Read MoreFor many small business owners and entrepreneurs, it is difficult to access loans, insurance and other types of financial services. This means they find it more difficult to grow their business, which can result in lost opportunities for employment and economic growth. Microfinance can help change this by providing these entrepreneurs with the capital they need to thrive.

Microfinance is a way to provide small business owners and entrepreneurs with access to capital.

How does microfinance work?

The term microfinance covers microcredit, microsaving and microinsurance.

Microfinance, created by Nobel Prize winner Muhammad Yunus, helps the financially marginalised by providing them with the capital they need to start a business and work towards financial independence. These loans are significant because they are provided even if the borrower has no collateral. However, the interest rates for these microcredits are often very high due to the risk of default.

Microcredit has been successful in helping many people who have previously been denied access to financial services. But it has also had its critics. Some argue that high interest rates and high default rates mean that microcredit is not always an effective way to help developing countries economically.

Microfinance institutions provide small loans and other resources to business owners and entrepreneurs to help them start their businesses. Many of the beneficiaries are in developing countries and would otherwise not be able to obtain a traditional loan.

Microsaving accounts also fall under the umbrella of microfinance. They allow entrepreneurs to have savings account with no minimum balance. And microinsurance provides these borrowers with insurance, at a lower rate and with lower premiums.

Microcredit is a small loan made available to low-income individuals who want to start their own business or improve their current business operations. It can be used for any number of things: buying materials or equipment; paying off debt; or paying for education or training courses that will help them start or grow their business.

Why is microfinance important?

Many people who can’t get access to traditional banking find microfinance loans and services to be an incredibly valuable resource. Microfinance provides a platform for these groups to build their financial health and achieve their goals by creating businesses and opening up lines of credit without high interest rates or excessive fees.

When families and individuals have access to the resources and capital they need, they are more able to invest in their businesses and increase their quality of life. This helps them improve their quality of life through increased income, investments in family welfare, or education.

Key benefits

Microfinance is a banking service provided to unemployed or low-income individuals or groups who would otherwise have no other access to financial services.

Microfinance enables people to borrow reasonable small business loans securely and in a manner consistent with ethical lending practices.

Most microfinance transactions occur in developing countries

Like conventional lenders, microfinanciers charge interest on loans and institute specific repayment schedules.

The World Bank estimates that more than 500 million people have benefited from microfinance-related operations.

Microfinance is an important element of poverty reduction initiatives. It can help underdeveloped countries to develop effectively. The most distinguished advantage of microfinance is that it offers opportunities to those who are not able to take on a bank loan. In the urban areas of developing countries, the poor are often unable to secure adequate housing and urban services due to a lack of collateral.

Microfinance can help such people borrow without any security involved and hence assist them in purchasing home or land. Microfinance encourages women’s empowerment by helping them secure loans that they can use for starting their own businesses and developing other social activities.

You migh also like

5 reasons every Startup needs a business credit card to scale and succeed

Starting a business is exciting, but managing finances can be...

Read More